Quick Way To Work Out 20 Vat

The next step would be to add this amount to the price so that it becomes VAT-inclusive at point-of-sale. If you know the price without VAT added on.

How To Calculate Turnover For Vat Registration In Uae Uae Calculator Registration

How To Calculate Turnover For Vat Registration In Uae Uae Calculator Registration

120 x 100 120 Thats pretty straightforward right.

Quick way to work out 20 vat. We can now use this multiplier to calculate VAT that should be added to a price. This can save you time to get on with running your business. Option below to see how this affected the price of goods.

Take the gross amount of any sum items you sell or buy that is the total including any VAT and divide it by 1175 if the VAT rate is 175 per cent. This is one of the reasons why I hate QuickBooks. How To Remove VAT.

Check the rate is correct its pre-set to the standard rate of 20 Click the Add VAT button. Ive also added the capability to select the VAT rate as the UK government has tweaked it between 15 175 and 20 during the last decade. How To Add VAT.

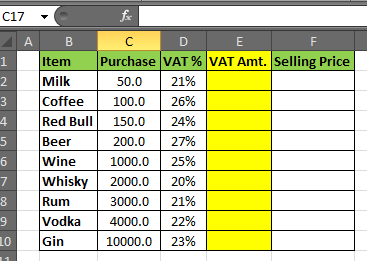

Calculate VAT from the total price of a product or service which includes VAT. Luckily its very easy to work out. However we only want to do this if the VAT Rate in Column B is 20.

14 divide by 100 014. Calculate sales tax backwards. This allows you to work out all the VAT you pay as a simple percentage of your turnover.

Adding removing and calculating VAT for your invoices can be done with a couple of clicks by using our VAT calculator. Welcome to my online VAT calculator a simple no frills easy to use calculator to work out the VAT on any amount whether it be adding or reversingsubtractingbackwards calculations. Try using VT accounts this is much easier.

This VAT calculator will help you to see how much tax should be added to a price or how much of the total price was made up by VAT. Excise Flat Rate Scheme. Currently VAT is at 14 therefore.

To work out a price excluding the reduced rate of VAT 5 divide the price including VAT by 1. Input the price exclusive of VAT. The multiplier is 114.

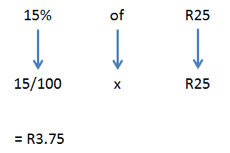

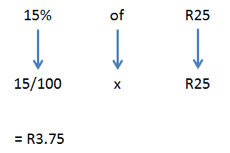

For example if the VAT-exclusive price of a smartphone is 100 the VAT will be 20 since 100 times 20 percent is 20. 31072015 To calculate the amount of VAT to add to a price we first need to calculate the multiplier. Step 1 - Enter the amount you wish to add VAT to or subtract from in the first field named Amount on the calculator.

Add or subtract VAT from a number. Step 2 - Next make sure the VAT rate with want to work with is correct in the field named Rate. On a more helpful note when I check a clients VAT balance I would also look at the Debtors.

VAT Calculator displayed on VATCalculatorUKcouk has been verified. 13092012 To work out a price excluding the standard rate of VAT 20 divide the price including VAT by 12. Including standard-rated reduced-rated or zero-rated sales only up to 150000 a year can join the flat rate scheme but once youve joined you can remain in the scheme until your total business income goes over 230000 a year.

For example a rate of 20 gives you a ratio of 120 thats 20100 02 1 12. The most efficient formula we can use to express this is to divide the gross amount by 120. If the rate is different add 100 to the VAT percentage rate and divide by that number Multiply the result from Step 1 by 100 to get.

Show how to work out VAT content at 20. 08112012 Only businesses with annual VAT taxable turnover using the normal way of working this out ie. Lets think about what these figures mean before we go on.

How to use this VAT Calculator. Approved by a Chartered Accountant. 15052014 Figuring out VAT on a calculator requires a percentage multiplication as well as an addition.

20092019 The easiest method is to calculate 1 first scale that up to 20 to calculate the VAT then add the VAT to the net to calculate the gross. Finance started by Sobie Nov 2 2010. How to work out VAT.

Choose 20 in the VAT Rate. Calculate the VAT element and then the same with the Creditors ensuring I remove those not subject to VAT such as Rates. 014 1 114.

20012015 Dont think so Ive not found a quick way yet. Enter the VAT rate UK standard rate is 20 Click Add VAT. Discussion in Accounts.

Take your VAT rate divide it by 100 and then add 1. The best way to learn how to calculate VAT at 20 assuming the net value of the product is 100 is. Following these simple steps can help you get it right.

14012016 VAT calculations work on the premise that the gross amount is 120 of the net amount. Enter the VAT rate UK standard rate is 20 Click Remove VAT. In the June 2010 Emergency Budget the Chancellor announced that from 4th January 2011 the standard rate of VAT will increase to 20 from 175.

Show how to get a number that includes VAT to exclude VAT. 11022021 Calculating VAT at 20. A more simple way to work out your VAT If your turnover is under 150000 excluding VAT you could be eligible for the Customs.

Take 20 off a price or any number. Heres how to use this free VAT calculator website.

Fitness For Vat Fitness Vat Motivatie Fitness Fitnessoefeningen Thuisfitness

Fitness For Vat Fitness Vat Motivatie Fitness Fitnessoefeningen Thuisfitness

Gst Calculator Is Now On Your Keyboard Easily Calculate Gst Vat Ct For Any Amount Totally Free Loan Carloan Finance Loans Finance Planner Planner Apps

Gst Calculator Is Now On Your Keyboard Easily Calculate Gst Vat Ct For Any Amount Totally Free Loan Carloan Finance Loans Finance Planner Planner Apps

Self Employed Invoice Templates Printable Invoice Template Business Template Template Printable

Self Employed Invoice Templates Printable Invoice Template Business Template Template Printable

Maths Tip Of The Day Percentages Here Are A Few Quick Tips To Calculate Percentage Increases And Decreases Maths Studytips Edu Math Tricks Study Tips Math

Maths Tip Of The Day Percentages Here Are A Few Quick Tips To Calculate Percentage Increases And Decreases Maths Studytips Edu Math Tricks Study Tips Math

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Download Uk Vat Purchase Register Excel Template Exceldatapro Excel Templates Templates Excel

Download Uk Vat Purchase Register Excel Template Exceldatapro Excel Templates Templates Excel

Reverse Vat Calculator Value Added Tax Calculator Free Online Tools

Reverse Vat Calculator Value Added Tax Calculator Free Online Tools

Guide To Getting Vat Tax Refunds On Your Shopping In Seoul South Korea Singapore Travel Blog Singapore Travel Tax Refund South Korea

Guide To Getting Vat Tax Refunds On Your Shopping In Seoul South Korea Singapore Travel Blog Singapore Travel Tax Refund South Korea

Vat And Your Company Documents What You Need To Know How To Plan Need To Know This Or That Questions

Vat And Your Company Documents What You Need To Know How To Plan Need To Know This Or That Questions

How To Charge Vat As A Freelancer In Germany Germany Freelance Work Abroad

How To Charge Vat As A Freelancer In Germany Germany Freelance Work Abroad

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Vat Calculator Value Added Tax Calculator Free Online Tools

Vat Calculator Value Added Tax Calculator Free Online Tools

Wealthy Maths How To Calculate Vat Just One Lap

Wealthy Maths How To Calculate Vat Just One Lap

Mpociot Vat Calculator Calculator Chart Line Chart

Mpociot Vat Calculator Calculator Chart Line Chart

Formulas To Include Or Exclude Tax Excel Exercise

Formulas To Include Or Exclude Tax Excel Exercise

Vat Advice For Small Businesses Easy As Vat Woman Business Owner Business Goods And Services

Vat Advice For Small Businesses Easy As Vat Woman Business Owner Business Goods And Services

Calculate Vat In Excel Excel Vat Formula Change This Limited

Calculate Vat In Excel Excel Vat Formula Change This Limited

Software For Vat Calculation Will Integrate All Processes And Data No Matter The Source Or Format Legislative Changes Are Tracked Easily Solving Data Finance

Software For Vat Calculation Will Integrate All Processes And Data No Matter The Source Or Format Legislative Changes Are Tracked Easily Solving Data Finance

0 Response to "Quick Way To Work Out 20 Vat"

Post a Comment